Got out of CSIQ on 11/21 @ 0.70 for $150 profit. Wanted to leg out of the spread and let the naked 27 call ride up, but I chose instead to take the money since my AAPL and YHOO positions are in the red.

Got into KING on 11/21, short 5 18/20c @ 0.60, got out today @ 0.30 for another $150 profit.

KING reacted exactly as anticipated to the gap fill resistance on Friday and continued to go lower today.

Both YHOO and AAPL have gone higher despite the fact that both are heavily overbought. I'm holding out this week and if they don't give up some ground, I'm going to have to get out of the trade.

Tuesday, November 25, 2014

Monday, November 17, 2014

AAPL and WFM

Got out of the WFM butterfly above my price target of 1.28... 1.34. That's $156 profit. Not too shabby for a spread I've never traded before.

Now, looking at AAPL:

AAPL is overbought on all the indicators and had some very negative price action today. A come down back to 110 or the 20ma is likely in my opinion. Decided to only nibble on this trade since my YHOO short continues to move against me; +2 Jan15 112.86/114.49p @ 0.75.

Now, looking at AAPL:

AAPL is overbought on all the indicators and had some very negative price action today. A come down back to 110 or the 20ma is likely in my opinion. Decided to only nibble on this trade since my YHOO short continues to move against me; +2 Jan15 112.86/114.49p @ 0.75.

Friday, November 14, 2014

Canadian Solar (CSIQ)

Looking for some positive Delta to offset my YHOO short, I found CSIQ

This stock has been sold off over the past month or so... and it reacted very positively to support. Normally, I do not chase a big move after it has bounced off support, but this one flew under the radar.

Trying to ride this up to resistance at 32, but that's a bit of a ways off! I'd be happy with getting out at the 20ma. Here's the trade: +6 Jan15 27/28c @ 0.40

Also, I'm looking at King Digital (KING)... yeah, those candy crush guys.

Reported good earnings I suppose. KING looks like it wants to gap fill, and it will most likely face significant resistance and be very overbought when it arrives at 17.20. Plan is to go short if and when that happens.

In addition, AAPL is just flying! It hits a new ATH every single day I think. I tried to short before and got whacked so this time I'll steer clear.

This stock has been sold off over the past month or so... and it reacted very positively to support. Normally, I do not chase a big move after it has bounced off support, but this one flew under the radar.

Trying to ride this up to resistance at 32, but that's a bit of a ways off! I'd be happy with getting out at the 20ma. Here's the trade: +6 Jan15 27/28c @ 0.40

Also, I'm looking at King Digital (KING)... yeah, those candy crush guys.

Reported good earnings I suppose. KING looks like it wants to gap fill, and it will most likely face significant resistance and be very overbought when it arrives at 17.20. Plan is to go short if and when that happens.

In addition, AAPL is just flying! It hits a new ATH every single day I think. I tried to short before and got whacked so this time I'll steer clear.

Monday, November 10, 2014

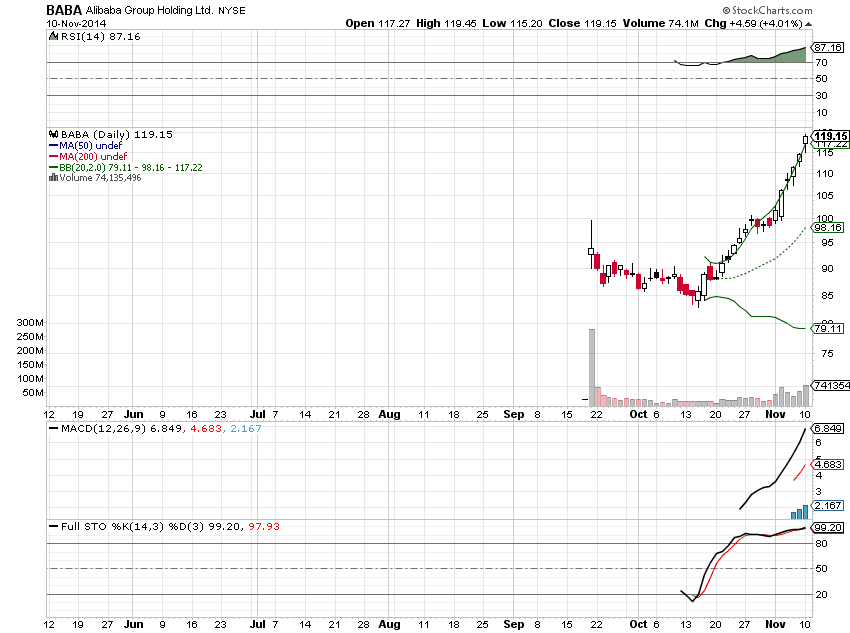

YHOO and BABA

For a long time, most of this year, Yahoo (YHOO) has traded just on what Alibaba's (BABA) share price is doing. Before BABA went public in the US about a month ago, YHOO traded on speculation of what BABA's share price would do. In other words, YHOO is a black box, nobody knows how the hell they make any money, and the stock trades on its stake in a Chinese online retail company. Wat?

Call it what you want.

Both stocks have been high flying over the past month, and they're looking overbought.

When a stock gets a little overheated, the incentive for the stockholders to "shed some weight" becomes ever larger. YHOO is up ~20% since it's earnings, not including the initial gap up. But look at BABA! It's up 30% over the same time frame!

So, why not short BABA? 1) The options aren't as fairly priced as YHOO 2) There is not enough technical indicator history or price history. Honestly, I think it's gonna suffer a little GPRO action... trade down about 10% or so in the coming weeks.

If the two trade in tandem, and YHOO is a little less volatile (33% vs BABA's 46%), then YHOO makes the better short pick. That way, if I'm wrong and they both move higher, at least YHOO will head higher slower than BABA.

Here's the trade: +3 Jan15 YHOO 48/50p @ 1.00

Call it what you want.

Both stocks have been high flying over the past month, and they're looking overbought.

When a stock gets a little overheated, the incentive for the stockholders to "shed some weight" becomes ever larger. YHOO is up ~20% since it's earnings, not including the initial gap up. But look at BABA! It's up 30% over the same time frame!

So, why not short BABA? 1) The options aren't as fairly priced as YHOO 2) There is not enough technical indicator history or price history. Honestly, I think it's gonna suffer a little GPRO action... trade down about 10% or so in the coming weeks.

If the two trade in tandem, and YHOO is a little less volatile (33% vs BABA's 46%), then YHOO makes the better short pick. That way, if I'm wrong and they both move higher, at least YHOO will head higher slower than BABA.

Here's the trade: +3 Jan15 YHOO 48/50p @ 1.00

Friday, November 7, 2014

Trying Something New!

Today I'm attempting to trade a spread that I've never tried before: a butterfly.

Butterflies are low cost, high ROC spreads where you essentially try to "thread the needle" and pin the stock price on expiration. I'm trying it in Whole Foods Market (WFM)

So, WFM released earnings two days ago, and it was a blowout apparently. The stock has completely reversed. Now, since IV has gotten murdered (25%), selling upside calls is not worth the risk for the credit taken in. So, instead, I predict that WFM will move higher, but stall out around the 48 level.

I expect this to happen over next week and maybe into the week after. So, take a look at the risk profile:

We risk $112 to potentially make $288 if we pin the stock on the nose at expiration. Anywhere between 46.5X and 49.4X at expiration will make money, which is right in that resistance area.

I don't expect to make money on this trade, just because it's totally new. So risking a max $112 (0.56% of capital) is basically nothing for an experimental trade.

Butterflies are low cost, high ROC spreads where you essentially try to "thread the needle" and pin the stock price on expiration. I'm trying it in Whole Foods Market (WFM)

So, WFM released earnings two days ago, and it was a blowout apparently. The stock has completely reversed. Now, since IV has gotten murdered (25%), selling upside calls is not worth the risk for the credit taken in. So, instead, I predict that WFM will move higher, but stall out around the 48 level.

I expect this to happen over next week and maybe into the week after. So, take a look at the risk profile:

We risk $112 to potentially make $288 if we pin the stock on the nose at expiration. Anywhere between 46.5X and 49.4X at expiration will make money, which is right in that resistance area.

I don't expect to make money on this trade, just because it's totally new. So risking a max $112 (0.56% of capital) is basically nothing for an experimental trade.

Tuesday, November 4, 2014

Keeping the Stride...

Since the start of this blog, my book is up over $21,000 for an 84% gain. If you don't count the kind of lucky profits I had earlier this year, so from June onward, I'm up over $7,000 for a 35% gain.

I prefer the latter stats because that has been accomplished without the risk (in terms of position size relative to capital) that I was taking before. I've managed to trade better with less capital!

Options are a phenomenal trading tool for the little guy, if he understands the risks and controls them. If anything, I've proven that many times over. How much are stocks up this year? 8 or 10%? I've tripled that in less than 5 months.

Don't get me wrong, investing still has its perks. For example, you can't take an income from your trading account. But I've got a whole other strategy for investing, which isn't in the name of this blog!

It really is unfortunate that many retail players in the options game have no f@$%ing clue what they're doing. I can't tell you how many times I head over to StockTwits and see utter nonsense thrown about. Nobody takes the time to learn how to do it the right way. I'm no expert, but I don't prance around social media pretending to be one either!

I've been learning by studying the veterans and by trial and error for over two years now. I've had my ass handed to me many times over that time; right when I thought I was really getting it... I would take a big loss because of an unforeseen mistake.

This blog is still intended for really only me; a place where I can jot down my thoughts and processes to refer back to in the future. But, it goes a long way in showing how if you take the time to learn, these little derivatives can make you a fortune.

I prefer the latter stats because that has been accomplished without the risk (in terms of position size relative to capital) that I was taking before. I've managed to trade better with less capital!

Options are a phenomenal trading tool for the little guy, if he understands the risks and controls them. If anything, I've proven that many times over. How much are stocks up this year? 8 or 10%? I've tripled that in less than 5 months.

Don't get me wrong, investing still has its perks. For example, you can't take an income from your trading account. But I've got a whole other strategy for investing, which isn't in the name of this blog!

It really is unfortunate that many retail players in the options game have no f@$%ing clue what they're doing. I can't tell you how many times I head over to StockTwits and see utter nonsense thrown about. Nobody takes the time to learn how to do it the right way. I'm no expert, but I don't prance around social media pretending to be one either!

I've been learning by studying the veterans and by trial and error for over two years now. I've had my ass handed to me many times over that time; right when I thought I was really getting it... I would take a big loss because of an unforeseen mistake.

This blog is still intended for really only me; a place where I can jot down my thoughts and processes to refer back to in the future. But, it goes a long way in showing how if you take the time to learn, these little derivatives can make you a fortune.

Subscribe to:

Posts (Atom)