I use a handful of indicators to determine whether stocks are overbought or oversold. While there is nothing wrong with this strategy, sometimes the moves in stocks on their way to being overbought or oversold can make money as well. This is called momentum trading and I'm not very good at it.

I'm a cynical guy, so I take moves in the market with a grain of salt. That's why I can perform well with a contrarian strategy.

Lately I've been looking at other indicators and their correlations with ones I currently use. One such pattern is with the MACD and the Commodity Channel Index (CCI).

Crosses on the MACD usually signal a continuation in the direction the stock is moving, but not always. I seem to have found a correlation that can signal when there is a "true cross" on the MACD. When the CCI crosses the zero line, it almost always coincides with a MACD cross. When the two match, the stock usually continues in the direction.

While indicators aren't magic bullets, telling you automatically when to buy and when to sell, they are good reference points. They guarantee nothing, which is why I am only dipping my toes.

So, XLE has gotten beat up but looks like it could rebound. It may also have a reversal... I don't know

Unfortunately, the IV just isn't high enough to sell premium, so I have to buy calls.

Here's the trade: +2 XLE March15 79/81c @ 1.00

Target is the gap just under 85, and I will attempt to leg out of this one just like MA.

Monday, December 22, 2014

Friday, December 12, 2014

One Last Home Run to Finish 2014

I've been quite busy writing papers and studying for finals, and I thought that I had posted about my entry into MasterCard (MA). Turns out I didn't.

Well about a week ago, MA was coming up as fairly overbought. So, like usual, I bought an ITM/ATM put spread, 3 of the Jan 89/91 for 1.00.

But I decided I was going to try a new strategy called "legging out." When put on a spread, you buy a contract and then sell a contract simultaneously. This hedges against losses but also caps gains. For a $2 wide spread, like 89/91, the max price of the spread is 2.00. So, if your short strike, in this case the 89 put, becomes ITM, you can take that off and "let the long put ride." This way, your gains aren't capped, and you can ride the downward momentum.

I was going to attempt to do this on YHOO and AAPL, but, as it turns out, I never got the chance because I was too early on entry. MA, however, worked beautifully.

I entered short MA on that peak black candle, because I like to see black candles above bollinger bands with a declining MACD and RSI > 70. It's an optimal short entry. This is a textbook Bflakaz overbought short play.

So I legged out on 12/9, and just kept the long put, the 91 strike, on. I had originally bought this side of the spread for 1.85 (the short 89 strike was a credit of 0.85, making the cost of the spread 1.00).

I exited and sold those puts today for 5.45 for a profit of $1080!!!

I really was not expecting that kind of success! The recent market slip-up definitely helped my position, so I got lucky on the timing in some respects but WOW!

Also, I was eyeing Stratasys (SSYS). It was getting oversold and approaching support at 85. It hit support at 85 and immediately bounced, then pared losses on the day. I entered a short put spread, Jan15 75/80 for 1.20 shortly after it confirmed support. SSYS then rallied hard yesterday, and I bought it back for 0.50 for a $140 profit.

I'm very close to reaching 100% ROC this year, but I don't think I'll make it.

Well about a week ago, MA was coming up as fairly overbought. So, like usual, I bought an ITM/ATM put spread, 3 of the Jan 89/91 for 1.00.

But I decided I was going to try a new strategy called "legging out." When put on a spread, you buy a contract and then sell a contract simultaneously. This hedges against losses but also caps gains. For a $2 wide spread, like 89/91, the max price of the spread is 2.00. So, if your short strike, in this case the 89 put, becomes ITM, you can take that off and "let the long put ride." This way, your gains aren't capped, and you can ride the downward momentum.

I was going to attempt to do this on YHOO and AAPL, but, as it turns out, I never got the chance because I was too early on entry. MA, however, worked beautifully.

I entered short MA on that peak black candle, because I like to see black candles above bollinger bands with a declining MACD and RSI > 70. It's an optimal short entry. This is a textbook Bflakaz overbought short play.

So I legged out on 12/9, and just kept the long put, the 91 strike, on. I had originally bought this side of the spread for 1.85 (the short 89 strike was a credit of 0.85, making the cost of the spread 1.00).

I exited and sold those puts today for 5.45 for a profit of $1080!!!

I really was not expecting that kind of success! The recent market slip-up definitely helped my position, so I got lucky on the timing in some respects but WOW!

Also, I was eyeing Stratasys (SSYS). It was getting oversold and approaching support at 85. It hit support at 85 and immediately bounced, then pared losses on the day. I entered a short put spread, Jan15 75/80 for 1.20 shortly after it confirmed support. SSYS then rallied hard yesterday, and I bought it back for 0.50 for a $140 profit.

I'm very close to reaching 100% ROC this year, but I don't think I'll make it.

Thursday, December 4, 2014

Bflakaz Trading Log 2014 Results

I most likely won't be trading much in December... finals, the Holidays, all that good stuff. It's been one helluva year!

The results are as follows:

Starting Capital = $25,000

Total Profit (gross) = $22,571.57

Return on Capital = 90.29%

Tuesday, November 25, 2014

More Profits and More Losses

Got out of CSIQ on 11/21 @ 0.70 for $150 profit. Wanted to leg out of the spread and let the naked 27 call ride up, but I chose instead to take the money since my AAPL and YHOO positions are in the red.

Got into KING on 11/21, short 5 18/20c @ 0.60, got out today @ 0.30 for another $150 profit.

KING reacted exactly as anticipated to the gap fill resistance on Friday and continued to go lower today.

Both YHOO and AAPL have gone higher despite the fact that both are heavily overbought. I'm holding out this week and if they don't give up some ground, I'm going to have to get out of the trade.

Got into KING on 11/21, short 5 18/20c @ 0.60, got out today @ 0.30 for another $150 profit.

KING reacted exactly as anticipated to the gap fill resistance on Friday and continued to go lower today.

Both YHOO and AAPL have gone higher despite the fact that both are heavily overbought. I'm holding out this week and if they don't give up some ground, I'm going to have to get out of the trade.

Monday, November 17, 2014

AAPL and WFM

Got out of the WFM butterfly above my price target of 1.28... 1.34. That's $156 profit. Not too shabby for a spread I've never traded before.

Now, looking at AAPL:

AAPL is overbought on all the indicators and had some very negative price action today. A come down back to 110 or the 20ma is likely in my opinion. Decided to only nibble on this trade since my YHOO short continues to move against me; +2 Jan15 112.86/114.49p @ 0.75.

Now, looking at AAPL:

AAPL is overbought on all the indicators and had some very negative price action today. A come down back to 110 or the 20ma is likely in my opinion. Decided to only nibble on this trade since my YHOO short continues to move against me; +2 Jan15 112.86/114.49p @ 0.75.

Friday, November 14, 2014

Canadian Solar (CSIQ)

Looking for some positive Delta to offset my YHOO short, I found CSIQ

This stock has been sold off over the past month or so... and it reacted very positively to support. Normally, I do not chase a big move after it has bounced off support, but this one flew under the radar.

Trying to ride this up to resistance at 32, but that's a bit of a ways off! I'd be happy with getting out at the 20ma. Here's the trade: +6 Jan15 27/28c @ 0.40

Also, I'm looking at King Digital (KING)... yeah, those candy crush guys.

Reported good earnings I suppose. KING looks like it wants to gap fill, and it will most likely face significant resistance and be very overbought when it arrives at 17.20. Plan is to go short if and when that happens.

In addition, AAPL is just flying! It hits a new ATH every single day I think. I tried to short before and got whacked so this time I'll steer clear.

This stock has been sold off over the past month or so... and it reacted very positively to support. Normally, I do not chase a big move after it has bounced off support, but this one flew under the radar.

Trying to ride this up to resistance at 32, but that's a bit of a ways off! I'd be happy with getting out at the 20ma. Here's the trade: +6 Jan15 27/28c @ 0.40

Also, I'm looking at King Digital (KING)... yeah, those candy crush guys.

Reported good earnings I suppose. KING looks like it wants to gap fill, and it will most likely face significant resistance and be very overbought when it arrives at 17.20. Plan is to go short if and when that happens.

In addition, AAPL is just flying! It hits a new ATH every single day I think. I tried to short before and got whacked so this time I'll steer clear.

Monday, November 10, 2014

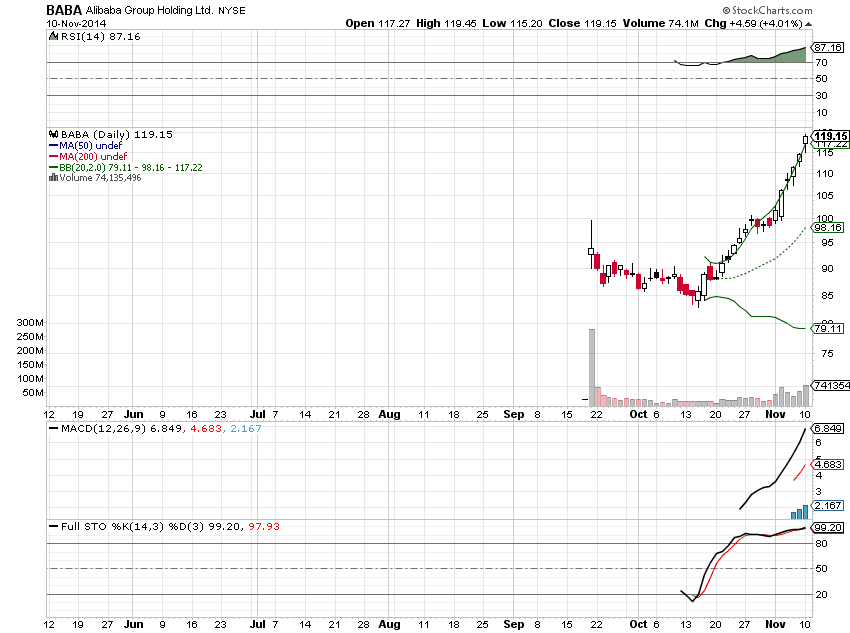

YHOO and BABA

For a long time, most of this year, Yahoo (YHOO) has traded just on what Alibaba's (BABA) share price is doing. Before BABA went public in the US about a month ago, YHOO traded on speculation of what BABA's share price would do. In other words, YHOO is a black box, nobody knows how the hell they make any money, and the stock trades on its stake in a Chinese online retail company. Wat?

Call it what you want.

Both stocks have been high flying over the past month, and they're looking overbought.

When a stock gets a little overheated, the incentive for the stockholders to "shed some weight" becomes ever larger. YHOO is up ~20% since it's earnings, not including the initial gap up. But look at BABA! It's up 30% over the same time frame!

So, why not short BABA? 1) The options aren't as fairly priced as YHOO 2) There is not enough technical indicator history or price history. Honestly, I think it's gonna suffer a little GPRO action... trade down about 10% or so in the coming weeks.

If the two trade in tandem, and YHOO is a little less volatile (33% vs BABA's 46%), then YHOO makes the better short pick. That way, if I'm wrong and they both move higher, at least YHOO will head higher slower than BABA.

Here's the trade: +3 Jan15 YHOO 48/50p @ 1.00

Call it what you want.

Both stocks have been high flying over the past month, and they're looking overbought.

When a stock gets a little overheated, the incentive for the stockholders to "shed some weight" becomes ever larger. YHOO is up ~20% since it's earnings, not including the initial gap up. But look at BABA! It's up 30% over the same time frame!

So, why not short BABA? 1) The options aren't as fairly priced as YHOO 2) There is not enough technical indicator history or price history. Honestly, I think it's gonna suffer a little GPRO action... trade down about 10% or so in the coming weeks.

If the two trade in tandem, and YHOO is a little less volatile (33% vs BABA's 46%), then YHOO makes the better short pick. That way, if I'm wrong and they both move higher, at least YHOO will head higher slower than BABA.

Here's the trade: +3 Jan15 YHOO 48/50p @ 1.00

Friday, November 7, 2014

Trying Something New!

Today I'm attempting to trade a spread that I've never tried before: a butterfly.

Butterflies are low cost, high ROC spreads where you essentially try to "thread the needle" and pin the stock price on expiration. I'm trying it in Whole Foods Market (WFM)

So, WFM released earnings two days ago, and it was a blowout apparently. The stock has completely reversed. Now, since IV has gotten murdered (25%), selling upside calls is not worth the risk for the credit taken in. So, instead, I predict that WFM will move higher, but stall out around the 48 level.

I expect this to happen over next week and maybe into the week after. So, take a look at the risk profile:

We risk $112 to potentially make $288 if we pin the stock on the nose at expiration. Anywhere between 46.5X and 49.4X at expiration will make money, which is right in that resistance area.

I don't expect to make money on this trade, just because it's totally new. So risking a max $112 (0.56% of capital) is basically nothing for an experimental trade.

Butterflies are low cost, high ROC spreads where you essentially try to "thread the needle" and pin the stock price on expiration. I'm trying it in Whole Foods Market (WFM)

So, WFM released earnings two days ago, and it was a blowout apparently. The stock has completely reversed. Now, since IV has gotten murdered (25%), selling upside calls is not worth the risk for the credit taken in. So, instead, I predict that WFM will move higher, but stall out around the 48 level.

I expect this to happen over next week and maybe into the week after. So, take a look at the risk profile:

We risk $112 to potentially make $288 if we pin the stock on the nose at expiration. Anywhere between 46.5X and 49.4X at expiration will make money, which is right in that resistance area.

I don't expect to make money on this trade, just because it's totally new. So risking a max $112 (0.56% of capital) is basically nothing for an experimental trade.

Tuesday, November 4, 2014

Keeping the Stride...

Since the start of this blog, my book is up over $21,000 for an 84% gain. If you don't count the kind of lucky profits I had earlier this year, so from June onward, I'm up over $7,000 for a 35% gain.

I prefer the latter stats because that has been accomplished without the risk (in terms of position size relative to capital) that I was taking before. I've managed to trade better with less capital!

Options are a phenomenal trading tool for the little guy, if he understands the risks and controls them. If anything, I've proven that many times over. How much are stocks up this year? 8 or 10%? I've tripled that in less than 5 months.

Don't get me wrong, investing still has its perks. For example, you can't take an income from your trading account. But I've got a whole other strategy for investing, which isn't in the name of this blog!

It really is unfortunate that many retail players in the options game have no f@$%ing clue what they're doing. I can't tell you how many times I head over to StockTwits and see utter nonsense thrown about. Nobody takes the time to learn how to do it the right way. I'm no expert, but I don't prance around social media pretending to be one either!

I've been learning by studying the veterans and by trial and error for over two years now. I've had my ass handed to me many times over that time; right when I thought I was really getting it... I would take a big loss because of an unforeseen mistake.

This blog is still intended for really only me; a place where I can jot down my thoughts and processes to refer back to in the future. But, it goes a long way in showing how if you take the time to learn, these little derivatives can make you a fortune.

I prefer the latter stats because that has been accomplished without the risk (in terms of position size relative to capital) that I was taking before. I've managed to trade better with less capital!

Options are a phenomenal trading tool for the little guy, if he understands the risks and controls them. If anything, I've proven that many times over. How much are stocks up this year? 8 or 10%? I've tripled that in less than 5 months.

Don't get me wrong, investing still has its perks. For example, you can't take an income from your trading account. But I've got a whole other strategy for investing, which isn't in the name of this blog!

It really is unfortunate that many retail players in the options game have no f@$%ing clue what they're doing. I can't tell you how many times I head over to StockTwits and see utter nonsense thrown about. Nobody takes the time to learn how to do it the right way. I'm no expert, but I don't prance around social media pretending to be one either!

I've been learning by studying the veterans and by trial and error for over two years now. I've had my ass handed to me many times over that time; right when I thought I was really getting it... I would take a big loss because of an unforeseen mistake.

This blog is still intended for really only me; a place where I can jot down my thoughts and processes to refer back to in the future. But, it goes a long way in showing how if you take the time to learn, these little derivatives can make you a fortune.

Thursday, October 30, 2014

update from phone

before I forget, here are some trades made recently

FB earnings strangle. sold tuesday bought back yesterday. 0.40 to 0.06 for a profit of 170

GPRO earnings play, a bull put spread. oct31 66/67 for 0.55. I was expecting a short squeeze, and we got exactly that. up 15% after earnings beat. will buy back tomorrow morning.

for tests on earnings I also paper traded some atm straddles in LNKDand GPRO. but those will be elaborated upon in my next good trade - bad trade post

FB earnings strangle. sold tuesday bought back yesterday. 0.40 to 0.06 for a profit of 170

GPRO earnings play, a bull put spread. oct31 66/67 for 0.55. I was expecting a short squeeze, and we got exactly that. up 15% after earnings beat. will buy back tomorrow morning.

for tests on earnings I also paper traded some atm straddles in LNKDand GPRO. but those will be elaborated upon in my next good trade - bad trade post

Tuesday, October 28, 2014

GPRO Success, On To FB

GPRO had a nice 8% bounce today, a little short covering rally. I was able to get out of that put spread for 0.10, netting $120 for a 60% gain. Why hold this until earnings when I can bank profits today? I'll take that!

FB reports earnings tonight. So I took a small position in the form of a short strangle 2 SD OTM. -4 70/90 for Oct31. IV is super high, so the crush will book some nice profits hopefully.

I'm remembering back to July of last year when I did the same thing... that was FB's turnaround earnings report. The stock soared 30% from 26 to above 30, and now its at 80. Nobody saw that shit coming, and I got my clock cleaned. Hopefully this time will be different... hopefully.

AAPL is up 1.4% as of writing, and the call spread is trading at about 1.60. That's an unrealized loss of $66 so far. Nothing I can't handle and it's getting more overbought in the process, but I never had much faith in it anyway, therefore I didn't risk hardly anything on it!

FB reports earnings tonight. So I took a small position in the form of a short strangle 2 SD OTM. -4 70/90 for Oct31. IV is super high, so the crush will book some nice profits hopefully.

I'm remembering back to July of last year when I did the same thing... that was FB's turnaround earnings report. The stock soared 30% from 26 to above 30, and now its at 80. Nobody saw that shit coming, and I got my clock cleaned. Hopefully this time will be different... hopefully.

AAPL is up 1.4% as of writing, and the call spread is trading at about 1.60. That's an unrealized loss of $66 so far. Nothing I can't handle and it's getting more overbought in the process, but I never had much faith in it anyway, therefore I didn't risk hardly anything on it!

Monday, October 27, 2014

GPRO Options Opportunity

I've made money in these options before trading the probabilities, and I'm going to try my hand at it once more.

GPRO reports earnings after the bell this Thursday. 0.08 EPS is expected. I believe the chance of a short squeeze post earnings is real, and here's why:

GPRO reports earnings after the bell this Thursday. 0.08 EPS is expected. I believe the chance of a short squeeze post earnings is real, and here's why:

- GPRO is already down 31% from its ATH

- Over 40% of the float are short, so for new short positions, its practically impossible to borrow shares

- Puts are way more expensive than calls, because investors want downside protection

So, because of these reasons, selling puts can be an attractive wager. On the Oct 31 put spread 10% below the market, a 0.50 wide spread will net you a credit of 0.25. That's pretty nuts, its a 1:1 risk-reward ratio!

If GPRO does anything but decline more than 10% on Friday, these sold puts will make money. And if it does go below the strike price, you can only lose the credit you got, or 100%. Usually on credit spreads, your max loss far exceeds net credit (but the probability is in your favor). Here, you can either make $25 or lose $25, and the odds, in my honest opinion, are in the put seller's favor.

In addition, the expectation is that GRPO falls like a rock. I can't find one positive opinion out there, or even a neutral one! Everyone on StockTwits is pounding the table on $50 as the next stop. To me, I'd rather take the risk of a coin toss and go Delta positive.

Here's the trade: -8 GPRO Oct31 60/59.50p @ 0.25

Max Risk and Max Profit are both $200, so nothing spectacular here.

Friday, October 24, 2014

I Don't Like Waiting...

There ain't a whole lot going on right now in the stock market. We've retraced a good chunk of the losses of the past couple of weeks, yes, the BTFD crowd is alive and well.

My methodology is support/resistance and overbought/oversold. So, currently, nothing is really happening. I missed most of the long opportunities from the rebound. But hey, can't catch 'em all, right?

So now I look to Apple (AAPL)

AAPL just reported solid earnings and gapped up a few days ago. It reached a fresh ATH today, and today's candle is completely outside the top bollinger band. RSI is below 70, and the stochastics are just now signaling overbuying, so I hope I'm not too early on this one. I believe that it can move down to gap fill or the 20ma, whichever comes first. Or, it could keep running higher, I don't know. That's why I'm not risking a whole heck of a lot here.

Bought 2 DEC14 105/100p for 1.93... max risk = $386 or 1.93% of capital.

My methodology is support/resistance and overbought/oversold. So, currently, nothing is really happening. I missed most of the long opportunities from the rebound. But hey, can't catch 'em all, right?

So now I look to Apple (AAPL)

AAPL just reported solid earnings and gapped up a few days ago. It reached a fresh ATH today, and today's candle is completely outside the top bollinger band. RSI is below 70, and the stochastics are just now signaling overbuying, so I hope I'm not too early on this one. I believe that it can move down to gap fill or the 20ma, whichever comes first. Or, it could keep running higher, I don't know. That's why I'm not risking a whole heck of a lot here.

Bought 2 DEC14 105/100p for 1.93... max risk = $386 or 1.93% of capital.

Wednesday, October 15, 2014

A Couple New Risk-Averse Positions

All cash lasted a while, didn't it?

I liked the price action in 2 ETFs today: TLT and XHB

I liked the price action in 2 ETFs today: TLT and XHB

iShares 20+ Year Treasury Bond Fund (TLT)

TLT is looking overbought, which isn't surprising given that stocks are getting hammered. Today though was just ridiculous. TLT flew higher and then closed below where it opened, which to me is short term bearish. the 10 year treasury bond dipped underneath 2% today for the first time since June of 2013, as it become more and more apparent to traders that the Fed obviously isn't going to raise interest rates.

Today I bought 4 of the Dec14 122/123p for 0.60... that's a max risk of $240 or 1.2% of capital.

SPDR Homebuilder ETF (XHB)

This is both a support play and a (kind of) hedge. Home builder stocks are pretty interest rate sensitive; if rates rise, mortgages are more expensive, demand for housing declines, they build less homes... and vise versa. XHB tagged its June 2013 double bottom lows, and is outside of its weekly BB range, which are much stronger ranges on weekly candles than daily. The fact that it closed up 1.66% today was a good sign given that stocks had their worst day since 2011... but even they pared losses to close down 0.75%.

I bought 5 of the Dec14 28/29c for 0.47 shortly after XHB reacted to that support level. They're now at 0.55, so I've logged paper profits of $40 already.

The hedge works like this: if TLT declines, XHB might as well. If TLT goes up, XHB might as well. Since XHB trades off of interest rate changes (mainly the 20+ year rates), it may react in tandem with TLT since that is a proxy for 20+ year rates.

Why the hedge? Well, check back to my post on October 1st, I called for the Russel 2000 to "fall precipitously and swiftly right down to 1040" if support around 1080 was broken. Yeah, I was totally right. But I didn't make a position! How foolish! As my SPY calls were getting destroyed, I could have been making a killing in IWM puts!

So, as long as the market is bleeding out, I will attempt to hedge my bets. It's been a long while since stocks have seen volatility like this, so there's no reason to start throwing money around.

Additionally, other opportunities that I was looking at and totally missed were GLD and, um, a SPY short! Instead of getting out and going short I started to defend why I was long the SPY... a mistake. I've been bearish on stocks all god damn Summer. Yet, there I was, pretending to be bullish because I had a long position. Lesson learned.

Here are the charts to go along with:

SPDR Gold Trust (GLD)

SPDR S&P 500 ETF (SPY)

Monday, October 13, 2014

Aaaaaand I'm all cash.

Read the previous post for market outlook.

PROOF that all the trades made were good trades, even though the stocks continued to move against me the entire time! Thanks, rolling strategies!

TKMR summed profit = $300

GPRO summed profit = $160

SPY loss = -$200

SCTY summed profit = $54

VIX profit = $150

Total = +$464

So even though the markets were in total free fall last week, I still managed to eek out some gains! The profits would have been much better if the market didn't tank last week, but that move only proves that they were good trades.... well, maybe not SPY. As it turns out, that's a name I haven't been very good at trading.

While I'm pissed that I didn't get the chance to pile in for the bear mauling because I was managing all these trades going against me, I'm very pleased with the result of all that feverish adjustment.

So for now, until the market catches a god damned bid, I will remain all cash. Being up almost 80% this year, I don't need to trade in a free falling market. Better to hang on to those gains, right?

PROOF that all the trades made were good trades, even though the stocks continued to move against me the entire time! Thanks, rolling strategies!

TKMR summed profit = $300

GPRO summed profit = $160

SPY loss = -$200

SCTY summed profit = $54

VIX profit = $150

Total = +$464

So even though the markets were in total free fall last week, I still managed to eek out some gains! The profits would have been much better if the market didn't tank last week, but that move only proves that they were good trades.... well, maybe not SPY. As it turns out, that's a name I haven't been very good at trading.

While I'm pissed that I didn't get the chance to pile in for the bear mauling because I was managing all these trades going against me, I'm very pleased with the result of all that feverish adjustment.

So for now, until the market catches a god damned bid, I will remain all cash. Being up almost 80% this year, I don't need to trade in a free falling market. Better to hang on to those gains, right?

Sunday, October 12, 2014

Sifting Through the Correction Noise

Last week was a bad week for stock markets... not just here, but globally. Many of the bears have come out of hibernation and called for the start of THE correction. I'm well-read on each and every bit of information they throw out to support their case, because I agree with (pretty much) all of itl the global economy is not growing, monetary policy isn't working, etc. I am in their camp when it come to being "bearish" on the economy...

Where I differ with them is their opinions on stock markets. Yes, I believe stocks are significantly overvalued. Yes, I believe that QE and ZIRP have caused massive miss allocation of resources in the economy. But do I believe that this is the tipping point? The start of a correction? Maybe. A reversal in trend, and potentially a bear market? Absolutely not!!

If you have been short the market at any point since 2009, you have lost money. Even looking at this year you have lost money, even as the Fed has been tapering off QE and discussing rate hikes. In late January and into early February, stocks had a nasty sell off due to the Ukraine crisis. What happened after? Stocks went higher. In April, stocks sold off because technology stocks were thrown out of favor by investors, mostly the nose-bleed value ones that generate no profit. Stocks went higher after. In early August, stocks sold off on the back of more negative news. Stocks went higher after.

The bears claim that this time is different. They have been saying this for years. It is NOT different! They claim that stock markets declining past their 200 day moving averages means more turmoil is ahead. While no one can be sure if this is going to be a full on correction, I highly doubt that this is the start of a reversal. And I've been calling for "this correction" since the beginning of the Summer.

First of all, ZIRP isn't going anywhere! Nobody in the US economy can afford higher interest rates, not even the government! All this talk of rate hikes is meant to spook investors and let a little air out of the bubble. The Fed may follow through with "ceremonial" rate hikes - 50 or 75bps - as to look like they've kept their word.

Some excuses they may use for not raising them further may include:

Where I differ with them is their opinions on stock markets. Yes, I believe stocks are significantly overvalued. Yes, I believe that QE and ZIRP have caused massive miss allocation of resources in the economy. But do I believe that this is the tipping point? The start of a correction? Maybe. A reversal in trend, and potentially a bear market? Absolutely not!!

If you have been short the market at any point since 2009, you have lost money. Even looking at this year you have lost money, even as the Fed has been tapering off QE and discussing rate hikes. In late January and into early February, stocks had a nasty sell off due to the Ukraine crisis. What happened after? Stocks went higher. In April, stocks sold off because technology stocks were thrown out of favor by investors, mostly the nose-bleed value ones that generate no profit. Stocks went higher after. In early August, stocks sold off on the back of more negative news. Stocks went higher after.

The bears claim that this time is different. They have been saying this for years. It is NOT different! They claim that stock markets declining past their 200 day moving averages means more turmoil is ahead. While no one can be sure if this is going to be a full on correction, I highly doubt that this is the start of a reversal. And I've been calling for "this correction" since the beginning of the Summer.

First of all, ZIRP isn't going anywhere! Nobody in the US economy can afford higher interest rates, not even the government! All this talk of rate hikes is meant to spook investors and let a little air out of the bubble. The Fed may follow through with "ceremonial" rate hikes - 50 or 75bps - as to look like they've kept their word.

Some excuses they may use for not raising them further may include:

- "Inflation is not running at our long term objective of 2%"

- "The labor market still shows slack"

- "Higher inflation can be tolerated after years of low inflation"

- "We don't want to cut off the recovery as soon as it finds its footing"

- "Recent trends in the currency market have allowed the committee to be less constrained in their timing of further rate hikes"

The FOMC has been extremely selective in their choice of words recently. They have been whispering things like, "The market's idea of the timing of rate hikes are not in line with the committee's," or, "Investors are not perceiving the risk of losses as real." They're trying to let the air out! They know god damn well that a real rate hike is pretty much impossible.

One way to tell this is that the bond market is totally calling the Fed's bluff. Look at 10 year treasury yields YTD for 2014:

Yields have done nothing but decline even though inflationary pressures have continued to rise and the Fed has been tapering QE and discussing rate hikes. In fact, they are at their lowest level since the taper tantrum in May of 2013!

#5 in the aforementioned list refers to currency market trends. Since investors on the whole believe that a rate hike is coming, and the ECB is planning to unleash a QE program and Japan prints indefinitely, the Dollar will appreciate in relation. The markets have already priced in a potential rate hike. What happens when that silly notion dissolves? Let's look to the past:

In 2010 the Dollar had a massive rally on the backs of the European debt crisis and the belief that the Eurozone may break up. That didn't happen, the crisis was largely contained, and the fall in the Dollar was just as precipitous as the rise! You mean to tell me that slowing growth in Europe and an obvious balderdash of a rate hike justify a rally in the Dollar like the Euro crisis did?! No, and it will soon decline as that realization sinks in.

In conclusion, while a correction is long overdue and may occur in the following weeks, it is very likely not the start of a reversal.

Wednesday, October 8, 2014

Trade Management 10/8/14

We've experienced some choppy, volatile trading in stocks this week. Here are some updates on positions.

SCTY

Converted this to an iron condor from a bull put yesterday and may have overcompensated. Old resistance was blown through on a large down day for stocks, maybe I jumped the gun.

The red lines are the range of the condor, blue are support/resistance, and green is a rough channel that SCTY has been in since the triple top. I expected SCTY to bounce more off the 55 support, but it did not want to get past 60, and sold off violently. Now instead of being a delta positive position, I've got a delta neutral, and it could head higher... sweet! (sarcasm) Part of that was me forgetting that I was in November contracts, not October, like the other credit trades I've got on. Rookie mistake and I'll probably pay for it...

SCTY jumped over 3% to 57 as I wrote this, come on man! :(

GPRO

Elaborated yesterday, the GPRO strangle has a wide range; the top end is off the chart! Blue lines once again show support, although this stock hasn't been trading long enough for it to form real support and resistance, so take those with a grain of salt.

TKMR

The ebola play lost steam as its drugs ended up not being used to treat the Dallas ebola patient. It sold off (as expected), and got dangerously close to the 20 short put. I rolled down the 35 call to 30 yesterday, so I now have a tighter range. The Dallas patient died today, and now CRMX or w/e has switched places with TKMR, so I'm a little worried this may see a resurgence. Take support/resistance lines with a grain of salt, again.

SPY

Holy Fed minutes batman! SPY tagged a double bottom today and is now forming a bullish engulfing candle, signaling a move higher. In addition, MACD is reading a divergence and is at previous "bounce" levels, so that is a good sign.

More importantly for the 196/198 bull call trade though, SPY must hold its long term bullish trend:

SPY has to close out the week above that trend line, or else we might see a further decline past 190.

The trend is your friend!

Tuesday, October 7, 2014

A Lesson in How to Properly Trade Options

Many retail traders have a gambling mentality. They think that a 1:3 risk:reward ratio is a good bet. What they fail to understand about trading is that it is not gambling, just like gambling is not betting.

Betting means taking a look at the odds... let's use horse racing as an example.

The following horses have these odds. Which one is your best bet? (1/10 means bet $1, receive $10 upon win)

Betting means taking a look at the odds... let's use horse racing as an example.

The following horses have these odds. Which one is your best bet? (1/10 means bet $1, receive $10 upon win)

Hoof Hearted............1/10

Seabiscuit.................1/3

Dapper Dan..............1/99

Kentucky Pride........1/36

Mr Ed.......................1/7

It's obvious that Seabiscuit has the best odds of winning. In response, his payout is substantially lower than the other horses. A risk-on better would put $20 on Hoof Hearted, a gambler would put $20 on Kentucky Pride (Dapper Dan ain't gonna win), and a betting man would put $10 on Seabiscuit. The house always wins, so this is still gambling, per say, but it's an analogy.

(I would personally bet Seabiscuit and Mr Ed in a perfecta box)

The same thing goes for options trading. Options are priced based on their probability of retaining intrinsic value upon expiration, meaning they can be profitably traded for shares at that time. What many retail traders fail to understand is this fundamental point. That, and they don't understand the other mathematical variables at play, aka the Greeks.

The Bad Trader

A bad trader will take a look at the following:

The bad trader will determine that the 100 strike call is a good trade. What is his analysis?

The Bad Trader thinks paying 3.50 x 100 = $350 is cheaper than paying $97 per share. He's right; in order to make the same gains he would need to buy 100 shares, $9700 compared to $350 He thinks that this is a "cheap" trade, and that he can only lose $350, right?

The fact is, GPRO must advance from 97 to 100 PLUS the price he paid for the call, 3.50. GPRO then must rise 6.7% by expiration to BREAK EVEN on the trade. It must rise far higher and faster than 103.50 in order to make any money. That certainly could happen, but everyday that it doesn't, the extrinsic value of his call option will diminish, no matter where GPRO goes. He only has 11 days for that to happen, 9 of which are trading days. Yes, even over the weekend, his call option loses value. This is called theta decay, elaborated here.

The Bad Trader also does not ask why the heck a call option so far out-of-the-money with such little time to expiration is priced so high. This is due to the underlying stock's implied volatility. The more a stock moves, the higher the IV, the higher the option price. To compare, here's an option chain of a low IV, similar price stock:

Notice how the strike call that is equidistant OTM as 100 is to 97 (3%) is 106. The 106 call is trading at 0.30! less than 1/10 of the GPRO strike. And the irony is the Bad Trader would make the same mistake, thinking the 106 call is cheap and buying it.

These kinds of trades happen all too often in retail trader world. After all, only 1 in 10 people who try their hand at trading will ever make money. What happens to the Bad Trader's GPRO 100 call? It will probably lose a lot of value this week, especially if GPRO doesn't move all that much.

A bad trade can still make money; the 100 call can still rise from 3.50 to 4.00, 4.50, 5.00, but that's GAMBLING. The chances of that happening are against him, heavily. This trade will most likely lose money.... a lot of money.

The Good Trader

The Good Trader knows all the inputs of an option price, and how to trade around them. He has studied the markets, and has probably lost money falling for the gambling mentality. But he has learned from that mistake. The good trader trades based upon PROBABILITY.

The Good Trader doesn't look as cool; he doesn't make huge profits like a gambler, but makes small profits consistently. In the long run, the Good Trader will win out. These are the 1 in 10.

The Good Trader will use statistical analysis when making his bet. He looks at a high IV stock like GPRO with a keen eye. He notices premiums are very high given the days to expiration (DTE) and decides to capitalize.

The Good Trader firsts tests his trade by pulling up a risk profile:

He observes the standard deviation lines (yellow) and the mean price line (blue), and then calculates the percentage chance that this trade expires OTM. This is done using Z-score.

Z = (x-µ)/Ϭ

where x is the strike price of the sold option, µ is the mean price, and Ϭ is the value of 1 standard deviation. From the above model, he can estimate that µ = 97 and Ϭ = 11. This gives him

Z = (115 - 97)/11 = 1.63

With this Z = 1.63 he can look at a bell curve and analyze the percent chance of the stock being at a price above or below our sold strikes (115 and 77.5). Thankfully we have the internet, and do not need to calculate this by hand.

The chance of the price rising or falling below or above our sold strikes upon expiration is 10.31%, and the chance of the price being somewhere in between the sold strikes is 89.69%.

Those are very good odds! The Good Trader places the trade, selling the 77.5 puts and 115 calls for 1.25 credit, meaning his maximum profit is $125 per spread. He does this 10 times, so his max profit is $1250.

If GPRO stays in between 77.5 and 115 for the next 5 or 6 days, he will profit immensely. If GPRO's IV percentile declines between now and expiration, he will profit even more.

Conclusion

The Bad Trader is essentially gambling that GPRO will rise even more, even though it has already risen substantially in recent weeks. The Good Trader is playing the odds heavily in his favor, and has a higher chance of making more money. Can the Bad Trader make money and the Good Trader lose money? Absolutely. But, the Good Trader had the better odds, and as long as he managed his loss and didn't bet more than he could handle, he will be fine. The Bad Trader, however, will fail to learn from the mistake since his trade made money, and will go on to continue recklessly gambling until his account goes to $0.

Wednesday, October 1, 2014

October Gets Off to a Spooky Start

But opportunity is here!

Now THAT'S terrifying!

Popping up on the radar this time are SPY, SCTY, TMKR, RUT, and the VIX

SPDR S&P 500 ETF (SPY)

Looking at the RSI and W%R, we're right at the "rebound" levels experienced on a weekly chart sine the onset of QE3 in September of 2013. We are also right on that weekly trend line since March of last year. If that fails to hold at this week's close, we might be in for some trouble. I don't think that's going to happen, I think the BTFD herd will come swooping in tomorrow and Friday, especially if we get a good September employment report. Today's big down move was apparently on the back of Ebola coming to the US and slowing growth indicator prints globally, though most notably in Germany. If we close out the week above that trend line, I'm looking to trade an ITM/ATM call spread for November.

SolarCity Corp (SCTY)

SCTY has been getting "moliwhopped" lately, declining about 17% last month. While it would have been a good short, and I know a few people who correctly predicted that move, but its oversold and good support is right around the corner. 1st is right around 54, the take off point (which blew up one my iron condor back in June). 2nd is the start of the "run-up-to" the take off point, and 3rd being that strong double bottom just south of 47. I will wait to see if support is confirmed at the 1st line before selling a put spread beneath the market, as IV is north of 60%.

Tekmira Pharmaceuticals Corporation (TKMR)

Don't need a chart for this, it's pretty simple. This stock was up over 30% today on the news of Ebola (one case, contained, and in Texas) coming to the US. This company makes hazmat suits. That's pretty much it. The stock has more than doubled in under a month but also sold off over 50% prior to that, meaning IV is, yeah, SUPER HIGH! OVER 100%! That means we can get crazy far away from the market for a call spread or strangle... except, the move was unanticipated, and there are no strikes that far away from the market on the call side to even trade. We'll see if that changes in the coming days, but if it doesn't happen soon, the trade might be gone.

RUSSEL 2000 Index (RUT)

Oh boy. The Russel 2000 is an index of small cap "growth" stocks (momo), and it's been having trouble getting anywhere this year. In fact, it's down on the year. Market top? I don't know, but it's once again sitting on that key support level. If that's broken, the shorts are going to pile in to this thing via its tracker ETF IWM. It's entering oversold territory, but that will not stop a bear mauling! If we fail to see a bounce here, naked puts on IWM will be attractive: the fall will be precipitous and swift, right down to 1040 at least. If we catch a bounce, a call spread will suffice, as it has rocketed off this support multiple times.

S&P 500 Volatility Index (VIX)

As you can see, everytime the VIX reaches this 17ish level, it drops quickly back down to its average area between 13 and 14. This time is no different, and if the S&P 500 is set to bounce of support, then the VIX will fall right back down. Selling Oct14 20/22 calls @ 0.30 will most likely prove profitable.

Monday, September 22, 2014

China & US Housing Data Disappoint on Monday

Stocks sold off ~0.75% today, helping my two short positions, WFC and GS

GS

Been looking to go short post Alibaba (BABA) hype train, proved to work well. We opened up above the top BB on Friday so I bought 2 185/190 Dec14 puts for 2.35... now trading at 2.65 +$60

Want to ride this down to 20ma and then close it out

WFC

Same thing for WFC on Friday, opened above top BB on an upgrade from (ironically) Goldman Sachs (GS). Filled 4 at 1.30 for NOV14 52.5/55 puts, now @ 1.60 +$120

Also want to ride this to 20ma

Tuesday, September 16, 2014

Learning to Walk...

The September 12 Weekend Review went over six new trades. Read that for details regarding set ups.

I liked the price action in almost every stock on Monday, and came in this morning for GILD as it opened under 100, which has acted like a trampoline of support the last two times it's printed under 100. Good decision!

Everything pretty much went according to plan, but a heck of a lot sooner than I had anticipated!

Here were the trades, all closed today:

Z: -3 115/120 SEP14 put @ 1.40, closed 0.50 profit = $270 +64%

XOM: +5 95/97.5 OCT14 call @ 0.98, closed 1.74 profit = $380 +78%

HD: +4 87.5/90 OCT14 call @ 1.25, closed 1.76 profit = $204 +41%

GILD +4 100/105 OCT14 call @ 1.65, closed 2.90 profit = $500 +76%

Total profit = $1354 in less than two days, holy cow!

This same thing was happening earlier this year. When I got back into trading after my lengthy hospital stay, I was on a very profitable hot streak. However, I took a lot more risk than I am now... cooling off a bit. I was given an excellent opportunity to short the "Great Momo Crash of 2014" that occured this past April, so why not take a little extra risk?

Since I started using the new brokerage platform, total profit has been $4,830.67 on $20,000 of capital. That's a Return on Capital (ROC) of 24.15% since June 25. So even despite the huge winning streak I had earlier this year, I have done very well!

A wise man (Aileron) once said, the trading learning curve looks something like this:

I liked the price action in almost every stock on Monday, and came in this morning for GILD as it opened under 100, which has acted like a trampoline of support the last two times it's printed under 100. Good decision!

Everything pretty much went according to plan, but a heck of a lot sooner than I had anticipated!

Here were the trades, all closed today:

Z: -3 115/120 SEP14 put @ 1.40, closed 0.50 profit = $270 +64%

XOM: +5 95/97.5 OCT14 call @ 0.98, closed 1.74 profit = $380 +78%

HD: +4 87.5/90 OCT14 call @ 1.25, closed 1.76 profit = $204 +41%

GILD +4 100/105 OCT14 call @ 1.65, closed 2.90 profit = $500 +76%

Total profit = $1354 in less than two days, holy cow!

This same thing was happening earlier this year. When I got back into trading after my lengthy hospital stay, I was on a very profitable hot streak. However, I took a lot more risk than I am now... cooling off a bit. I was given an excellent opportunity to short the "Great Momo Crash of 2014" that occured this past April, so why not take a little extra risk?

Since I started using the new brokerage platform, total profit has been $4,830.67 on $20,000 of capital. That's a Return on Capital (ROC) of 24.15% since June 25. So even despite the huge winning streak I had earlier this year, I have done very well!

A wise man (Aileron) once said, the trading learning curve looks something like this:

crawl... walk... run

And I'm just learning to walk.

Friday, September 12, 2014

September 12 Weekend Review

Markets are in a bit of a slump recently, unsure of where to go next. That's also reflecting in a lot of my "go-to" stocks that I trade fairly often.

However, there's a lot of important stuff that's ahead. The potential for increased volatility in the coming weeks has traders buying up VIX calls. The Scottish Secession election, the next big Fed policy meeting, Alibaba IPO, and what the ECB and BoJ (Bank of Japan) are doing will affect the markets in the coming weeks into October.

That said, there are a few stocks coming up on the radar: HD, MSFT, Z, GILD, GS, and XOM.

HD had a massive gap up after earnings, fueled by optimistic guidance. It has since sold off a bit, back to the gap up levels, and is finding support around 89 bucks. I missed the overbought and short opportunity, but what happens next week I think will largely determine the next move. Short term indicators are reading oversold, but long term ones remain ambiguous. We may see a bounce here, but if that support level breaks, 86 is next followed by a gap fill to 84. A bounce means a test of the highs at 93 are next. Given the aforementioned events happening next week, I see the odds as going lower rather than higher.

However, there's a lot of important stuff that's ahead. The potential for increased volatility in the coming weeks has traders buying up VIX calls. The Scottish Secession election, the next big Fed policy meeting, Alibaba IPO, and what the ECB and BoJ (Bank of Japan) are doing will affect the markets in the coming weeks into October.

That said, there are a few stocks coming up on the radar: HD, MSFT, Z, GILD, GS, and XOM.

Home Depot (HD)

HD had a massive gap up after earnings, fueled by optimistic guidance. It has since sold off a bit, back to the gap up levels, and is finding support around 89 bucks. I missed the overbought and short opportunity, but what happens next week I think will largely determine the next move. Short term indicators are reading oversold, but long term ones remain ambiguous. We may see a bounce here, but if that support level breaks, 86 is next followed by a gap fill to 84. A bounce means a test of the highs at 93 are next. Given the aforementioned events happening next week, I see the odds as going lower rather than higher.

Microsoft (MSFT)

While yesterday would have been better timing, MSFT is reading as overbought on all indicators and is bumping the top Bollinger Band. This one will be a decent short opportunity if we get a move back up above that BB, with a likely decline back to the 20ma (the dotted green line).

Zillow (Z)

Z was another short opportunity missed. When a stock is in a strong uptrend, the 50ma provides support of that trend. Once broken significantly, the stock trades down. Z has support levels around 125, and is reading as oversold on short term indicators while approaching oversold on long term indicators. It is also hitting the bottom BB. There is significant upside here, so it needs to confirm support at 125 before I would consider getting behind some calls (or selling puts).

Gilead (GILD)

GILD has been in a very strong uptrend for two years, but has recently been running into trouble. While I called the overbuying and profited very handsomely from that, it's time to look at the long side. No indicators are pointing to overselling yet, and I don't know if they will. They don't get down there very often, people want this stock! Buying LEAP calls will be a good trade once this stock cools off a little bit, determined by whichever comes first: indicators turn red, or it finds some support and bounces. Either will be a good entry.

Goldman Sachs (GS)

GS is the lead underwriter of the upcoming Alibaba IPO. It's expected to be the biggest IPO in history (is that a signal of a market top? Time will tell!) and make many billions of dollars for GS. I believe that's already been priced in mostly, but that hasn't stopped rampant call buying for GS. This will be a prime short if it produces a blow-off top, as it is already reading as oversold on all indicators and is wanting to break through that top BB. Alibaba IPO is in the next week or two.

Exxon Mobil (XOM)

XOM has been getting beat up along with crude oil prices, as the two trade in tandem. Short term technicals indicate overselling, long term are approaching oversold territory. XOM is continuing to push below bottom BB. Support is at 95, if it drops to there and holds, I'd look to go long and ride it back to the 20ma.

Friday, September 5, 2014

What a Week!!!!

Check back to the labor day post because I totally nailed it. Again.

Those SPX SEP14 1990 puts? Bought 1 Tuesday for 11.50, sold it this morning after jobs # for 16.00

That's a profit of $450 while only using 5.75% of capital.

But I'm not done...

NFLX hit that double top on Wednesday and continued to decline Thursday. Bought 1 SEP14 475p for 7.40, sold yesterday for 10.25. That's a profit of $285 using 3.7% of capital.

BUT WAIT BECAUSE HERE'S THE BIGGUN.

GILD was rampantly overbought heading into this week; ATH MACD levels, ATH RSI levels, and a lengthy period of time above 70 to boot. So on Tuesday I bought 3 SEP14 105p for 1.50. GILD sold off hard this morning, hitting 97.54! I was able to get out of dodge just as it was rebounding, and sold those puts for 6.50 a pop, making out with a profit of $1500 on 2.25% of capital. YEAH BUDDY!!!

That's a total of $2235 in one week, the best week since March 22 when all the momo's began to crash, and taking less risk.

And it brings total profits this year to... wait for it...

Those SPX SEP14 1990 puts? Bought 1 Tuesday for 11.50, sold it this morning after jobs # for 16.00

That's a profit of $450 while only using 5.75% of capital.

But I'm not done...

NFLX hit that double top on Wednesday and continued to decline Thursday. Bought 1 SEP14 475p for 7.40, sold yesterday for 10.25. That's a profit of $285 using 3.7% of capital.

BUT WAIT BECAUSE HERE'S THE BIGGUN.

GILD was rampantly overbought heading into this week; ATH MACD levels, ATH RSI levels, and a lengthy period of time above 70 to boot. So on Tuesday I bought 3 SEP14 105p for 1.50. GILD sold off hard this morning, hitting 97.54! I was able to get out of dodge just as it was rebounding, and sold those puts for 6.50 a pop, making out with a profit of $1500 on 2.25% of capital. YEAH BUDDY!!!

That's a total of $2235 in one week, the best week since March 22 when all the momo's began to crash, and taking less risk.

And it brings total profits this year to... wait for it...

$18,421.57

That's on $25,000 of capital that I started the this blog off with, making ROI... wait for it...

+73.69%

So to anyone who has read this blog, at all, you were getting rock solid trading info. I may be an intermediate trader, and I'm still learning, but you can't argue with these results!

Feel free to ask questions about the markets, trading methodology, indicators, risk, charts, ANYTHING!

For most people, financial markets are untenable and unintelligible. Let me help change that!

Monday, September 1, 2014

September 1 Weekend Review

Happy Labor Day!

Three items on the agenda this week: SPX & VIX, NFLX, and GILD

SPX & VIX

The month of August has seen a 4 week surge in stocks on lower than normal volume. That's because many senior traders are on vacation, and junior traders aren't really allowed to make decisions - they just let the algorithms run and make sure they don't get screwy.

As the SPX runs higher into 2000 territory, it's approaching 70 on RSI, a big divergence on MACD, and has already spent a good chunk of time above -20 on W%R. The VIX, meanwhile, is approaching that "complacency rampant" floor of 10.50. Everytime the VIX has dipped below 11 it has jumped right back up, meaning stocks gave up some ground.

This being said, no market correction is coming:

So it's just a trade. The SEP14 1990 SPX puts have been deflated in price very much, they're dirt cheap and aren't accurately pricing risk. Don't trade the VIX, it won't run high enough to make money.

NFLX

NFLX is not rampantly overbought, but it looks like it may make a double top and retreat a bit. Puts here have also been deflated, meaning they're cheap and not accurately pricing risk. Watch this one, it is not ready to be traded.

GILD

GILD is overbought currently and is prime for a small pull back. This can be traded in either direction, buying an ATM put spread (IV is low) or waiting for the pullback and loading long term calls. This company is a dynamo, look at the chart! It has continued to grow earnings and is one of the darlings of the white-hot biotech sector. It's in a very strong uptrend and is going nowhere but up in the months to come, making January 2015 (LEAP) calls very attractive once they come down in price after the impending pullback.

Unrelated, here's a completely arbitrary price forecast for SPX at year end: 2150

How's yours any more accurate?

Friday, August 29, 2014

LNKD Update and the Future of Bflakaz Trading Log

The LNKD position is halfway to expiration... I've been in it 3 weeks and have 3 weeks to go. Here's an updated chart:

The original trade was a bear call spread with 225/230 as the strikes for 1.40. This entire week LNKD has been trying to chug past 225 but has been running into some resistance. It's STILL reading as overbought on the RSI and had a negative MACD cross this week, which is typically a sell signal when the RSI > 70.

On the 25th I converted the spread to an iron condor, selling the 200/205 put spread for 0.70. The trade isn't a profit-seeking trade anymore, it's a loss-reducing one. By converting this to an iron condor I was able to take in more credit without taking any additional risk. Already the losses on the trade have been nearly cut in half, even though LNKD has done next to nothing this past week. In the last update, the trade was down

-$200, and now it's down -$108.

Next week if LNKD moves higher or remains stagnant, the puts will have to be rolled up, again allowing me to take in more credit. What I expect to happen is a small pull back to the 215-218 area which will allow me to exit the trade near unscathed. It just seems a little tired to me, so a breather will be required before continuing past the next area of resistance at 230. Fortunately, theta will begin to take its toll on option premiums next week, which will work in our favor regardless of where LNKD moves.

As for the future of my trading, it's going to be light. This semester is going to be "labor intensive," so I won't have as much time for proper analysis and execution of trades. This year has already been immensely profitable compared to last year, so to me there's no rush to get back in.

In addition, the markets right now are... well boring. There are no stocks on my radar that meet criteria for trading in my methodology, and stocks are unsure of where to go. While S&P 2000 is technically meaningless, it has a psychological effect. We've come so far, and the only thing that participants say will take us higher is the fact that rates are going to remain low. That doesn't sound enthusiastic to me, so we will probably churn higher until inevitably another mini sell off comes and everyone succumbs to BTFD again.

Abenomics is failing in Japan, ECB is about to unleash QE, US housing is struggling... the world economy looks awful, and yet here we are. While I'm not bearish on stocks right now, I don't see any reason of owning them way up here in the nosebleeds. Sure, they will probably go higher, but at what risk? SPX may reach 2100 by the end of the year, but it was quite a long fight to go from 1900 to 2000, unlike in 2013 where every other month was another 100pt move. Not only is complacency rampant in this market, but so is apathy. Unfortunately, I care too much!

The original trade was a bear call spread with 225/230 as the strikes for 1.40. This entire week LNKD has been trying to chug past 225 but has been running into some resistance. It's STILL reading as overbought on the RSI and had a negative MACD cross this week, which is typically a sell signal when the RSI > 70.

On the 25th I converted the spread to an iron condor, selling the 200/205 put spread for 0.70. The trade isn't a profit-seeking trade anymore, it's a loss-reducing one. By converting this to an iron condor I was able to take in more credit without taking any additional risk. Already the losses on the trade have been nearly cut in half, even though LNKD has done next to nothing this past week. In the last update, the trade was down

-$200, and now it's down -$108.

Next week if LNKD moves higher or remains stagnant, the puts will have to be rolled up, again allowing me to take in more credit. What I expect to happen is a small pull back to the 215-218 area which will allow me to exit the trade near unscathed. It just seems a little tired to me, so a breather will be required before continuing past the next area of resistance at 230. Fortunately, theta will begin to take its toll on option premiums next week, which will work in our favor regardless of where LNKD moves.

As for the future of my trading, it's going to be light. This semester is going to be "labor intensive," so I won't have as much time for proper analysis and execution of trades. This year has already been immensely profitable compared to last year, so to me there's no rush to get back in.

In addition, the markets right now are... well boring. There are no stocks on my radar that meet criteria for trading in my methodology, and stocks are unsure of where to go. While S&P 2000 is technically meaningless, it has a psychological effect. We've come so far, and the only thing that participants say will take us higher is the fact that rates are going to remain low. That doesn't sound enthusiastic to me, so we will probably churn higher until inevitably another mini sell off comes and everyone succumbs to BTFD again.

Abenomics is failing in Japan, ECB is about to unleash QE, US housing is struggling... the world economy looks awful, and yet here we are. While I'm not bearish on stocks right now, I don't see any reason of owning them way up here in the nosebleeds. Sure, they will probably go higher, but at what risk? SPX may reach 2100 by the end of the year, but it was quite a long fight to go from 1900 to 2000, unlike in 2013 where every other month was another 100pt move. Not only is complacency rampant in this market, but so is apathy. Unfortunately, I care too much!

Friday, August 22, 2014

August 23 Weekend Review

It's been two weeks since I put on the latest 3 trades in Z, TSLA, and LNKD. I'll review how each one went.

First up, Z

Point and shoot trade... entered when Z was at the 50MA, which has proven strong support for Z over the past 6 months. Targeted the area where I believe it was oversold, though no indicators showed that, at 145.

Total Profit: 200(1.45) - 200(0.55) = $180 +62%

Next, TSLA

Point and shoot trade... entered when TSLA was approaching its ATH resistance, marked by the upper red line. TSLA confirmed ATH resistance twice, sold off to gap fill, marked by the lower red line.

Total Profit: 200(1.67) - 200(1.15) = $104 +31%

And lastly, LNKD

I'm still in this trade, SEP14 225/230 calls... I was a little early as LNKD was still quite a ways from resistance. They've increased in price substantially, and I'm a bit in the hole right now, -$200. I was pretty sure this thing would roll over to 210, the bottom red line, after confirming the first resistance line, the middle red line. Today was most likely a short covering rally, as volume steadily increased through the day. One might call today a clean breakout... I call it a blowoff. That's because LNKD is still massively overbought, with and RSI reading of 81.65 and 52 week high MACD values. What comes up, must come down. Next week I will be looking to form an Iron Condor to reduce losses if LNKD continues to defy gravity.

Next week will be important for the markets overall. SPX has rebounded from that messy tumble completely, but is having a little difficulty pushing past the previous ATH resistance. As I've stated before, even though I was expecting a sell off, a full on correction is not going to happen. There are too many kool-aid drinkers that are keeping the BTFD train chugging. If stocks fail to break that resistance next week, then LNKD may finally pull back a little.

The dog days of Summer are almost over, and while I still believe that stocks are very overvalued, the market will continue to churn higher. SPX WILL break 2000 soon enough. Though that's arbitrary, maybe it will finally be the last umph before we inevitably come tumbling down the mountain.

The key numbers to watch in the coming months will be PCE and CPI... employment numbers at this point are meaningless. We passed the unemployment % threshold for a rate hike months ago. If market participants think that higher CPI and PCE numbers may cause the Fed to hike rates sooner (THEY WON'T), then we may finally get a meaningful pullback, not necessarily a correction. Also, keep an eye on the VIX floor around 10.30. It has jumped off that floor three times, triggering stock sell offs.

First up, Z

Point and shoot trade... entered when Z was at the 50MA, which has proven strong support for Z over the past 6 months. Targeted the area where I believe it was oversold, though no indicators showed that, at 145.

Total Profit: 200(1.45) - 200(0.55) = $180 +62%

Next, TSLA

Point and shoot trade... entered when TSLA was approaching its ATH resistance, marked by the upper red line. TSLA confirmed ATH resistance twice, sold off to gap fill, marked by the lower red line.

Total Profit: 200(1.67) - 200(1.15) = $104 +31%

And lastly, LNKD

I'm still in this trade, SEP14 225/230 calls... I was a little early as LNKD was still quite a ways from resistance. They've increased in price substantially, and I'm a bit in the hole right now, -$200. I was pretty sure this thing would roll over to 210, the bottom red line, after confirming the first resistance line, the middle red line. Today was most likely a short covering rally, as volume steadily increased through the day. One might call today a clean breakout... I call it a blowoff. That's because LNKD is still massively overbought, with and RSI reading of 81.65 and 52 week high MACD values. What comes up, must come down. Next week I will be looking to form an Iron Condor to reduce losses if LNKD continues to defy gravity.

Next week will be important for the markets overall. SPX has rebounded from that messy tumble completely, but is having a little difficulty pushing past the previous ATH resistance. As I've stated before, even though I was expecting a sell off, a full on correction is not going to happen. There are too many kool-aid drinkers that are keeping the BTFD train chugging. If stocks fail to break that resistance next week, then LNKD may finally pull back a little.

The dog days of Summer are almost over, and while I still believe that stocks are very overvalued, the market will continue to churn higher. SPX WILL break 2000 soon enough. Though that's arbitrary, maybe it will finally be the last umph before we inevitably come tumbling down the mountain.

The key numbers to watch in the coming months will be PCE and CPI... employment numbers at this point are meaningless. We passed the unemployment % threshold for a rate hike months ago. If market participants think that higher CPI and PCE numbers may cause the Fed to hike rates sooner (THEY WON'T), then we may finally get a meaningful pullback, not necessarily a correction. Also, keep an eye on the VIX floor around 10.30. It has jumped off that floor three times, triggering stock sell offs.

Subscribe to:

Posts (Atom)