For a long time, most of this year, Yahoo (YHOO) has traded just on what Alibaba's (BABA) share price is doing. Before BABA went public in the US about a month ago, YHOO traded on speculation of what BABA's share price would do. In other words, YHOO is a black box, nobody knows how the hell they make any money, and the stock trades on its stake in a Chinese online retail company. Wat?

Call it what you want.

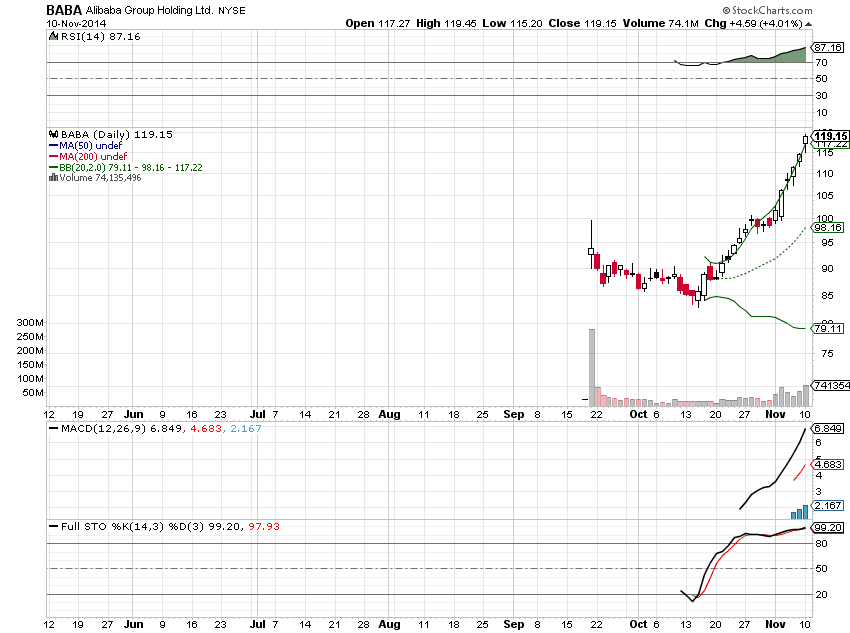

Both stocks have been high flying over the past month, and they're looking overbought.

When a stock gets a little overheated, the incentive for the stockholders to "shed some weight" becomes ever larger. YHOO is up ~20% since it's earnings, not including the initial gap up. But look at BABA! It's up 30% over the same time frame!

So, why not short BABA? 1) The options aren't as fairly priced as YHOO 2) There is not enough technical indicator history or price history. Honestly, I think it's gonna suffer a little GPRO action... trade down about 10% or so in the coming weeks.

If the two trade in tandem, and YHOO is a little less volatile (33% vs BABA's 46%), then YHOO makes the better short pick. That way, if I'm wrong and they both move higher, at least YHOO will head higher slower than BABA.

Here's the trade: +3 Jan15 YHOO 48/50p @ 1.00

No comments:

Post a Comment